Today’s customers have two characteristics: tech-savvy to a greater degree, and they are always with a mindset to finish the tasks urgently. To provide the users with the best devices and fulfil the current trends, financial institutions should consider deploying banking kiosks in India to meet their demands and provide them with the new, customer-centric experience they demand. Your institution will have up-to-date, seamless user service by expanding the technology portfolio.

Customers nowadays tend to switch to organisations with superior customer support and a quicker, more efficient user interface. If the organisations fail to provide the speed and comfort that consumers demand, it can be a significant challenge. The Reserve Bank of India launched a banking kiosk in India to provide essential banking services to the vulnerable and low-income groups in their communities at a low cost without going to the bank. Majorly, the move is to benefit the lower income group of the society and the people with a rural backdrop.

It is a program designed to help the poorest society members, who are typically daily wage earners and unable to keep a minimum balance in their bank accounts and unable to drive long distances to obtain banking services because banks are difficult to come by in villages and rural areas.

A kiosk computer is a self-operated banking device that allows users to make multiple cash and non-cash transactions such as money transfers, account statement printing, cheque book requests, bill payments, and query resolution.

The banking kiosk in India is a relatively new advancement of banking technology. It comes with a lot of features. The following are some characteristics that differentiate a kiosk banking outlet from an Automated Teller Machine (ATM):

Kiosk Banking Has a Wide Range of Services

Unlike ATMs, which are only suitable for cash transactions, a banking kiosk in India provides a wide variety of cash and non-cash transaction options.

The below are some of the services that a CSP and a kiosk machine will provide to the customers:

- To order a cheque book: check your account balance, and print a mini statement.

- Customer Service Resources: Via video conferencing, the customer will answer their questions from the support desk representative.

- MIS Reporting: It reduces workload by making it easier to create the customer’s database and MIS reports.

- Cheque Deposit Facility: Banking kiosks in India have simplified the process of depositing checks.

- Internet Banking: It provides consumers with net banking services, such as internet transfers.

- General Purpose Credit Card/Kisan Credit Card: Kiosk banking outlets issue the GCC and KCC to raise the poorer members of society’s buying power.

- Send a New Cheque Book: Kiosk banking allows you to get a new chequebook.

- Change Beneficiary Information: At a kiosk banking outlet, the customer may change the account beneficiary details if required.

- Loan Facility: Through kiosk banking, account holders may apply for a loan against their time deposits.

Customer’s personal information, fingerprints, and photos are collected at the kiosk banking outlet to open a no-frills account. All of the information gathered is submitted to the affiliated bank branch for processing. The Know Your Customer procedure is carried out by the associated bank branch. After the customer’s KYC has been updated, they will use the industrial kiosk branch to manage his account and take advantage of different banking facilities.

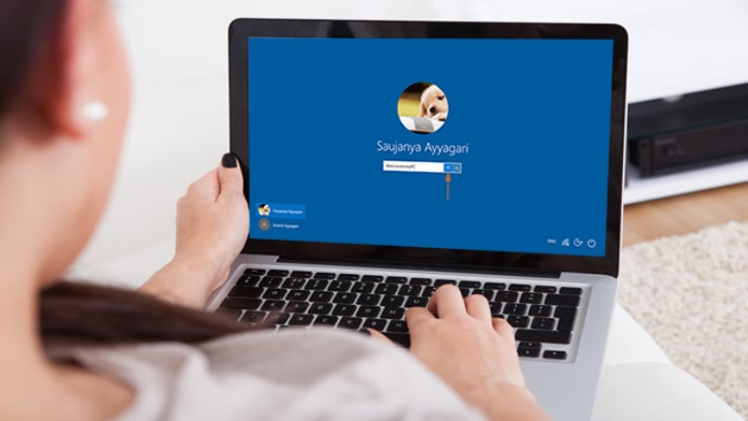

Self-service kiosks at banks and credit unions have various purposes, including providing customers with the sleek shopping environment they’ve come to demand from other retailers. The banking kiosk in India is distinguished from a conventional banking system by several technological characteristics. A keyboard with trackball, barcode reader, cash acceptor, touch and non-touch monitor, video camera, integrated full-page thermal printer, and integrated speaker are just a few of the features. consumers use them due to their improved visibility.

To execute purchases or complete a mission, these systems have an integrated touchscreen display, leading cash handling equipment, and key integrations. The banking kiosk in India is also known as Personal Teller Machines. These are the financial technology counterpart to airport kiosks that allow passengers to check-in and print boarding passes and fast-food restaurant kiosks to enable customers to order their meals.

Learn more about another topic watchcartoononline.

Fast-food restaurant kiosks and grocery store self-checkout stations allow customers to order their meals without interacting with someone behind the counter. Self-service banking kiosks, unlike conventional ATMs, connect directly to the institution’s core infrastructure. Customers will appreciate a more diverse and value-added transaction collection due to their freedom from ATM rails.

Read more about: imgupload