In some of the states of America, it is the law by the government that the employer is responsible for making the pay stub for the employee. But, in many places, you will not be finding the pay stub. If you are the employer and you are living in the state for you are familiar with the law of the country to make the pay stub then you can make the stub very easily. Even though it is the responsibility of the experts in the field, in the 21st century, there is much-dedicated software made easy for the user to make the pay stub very easily and efficiently.

Get every information

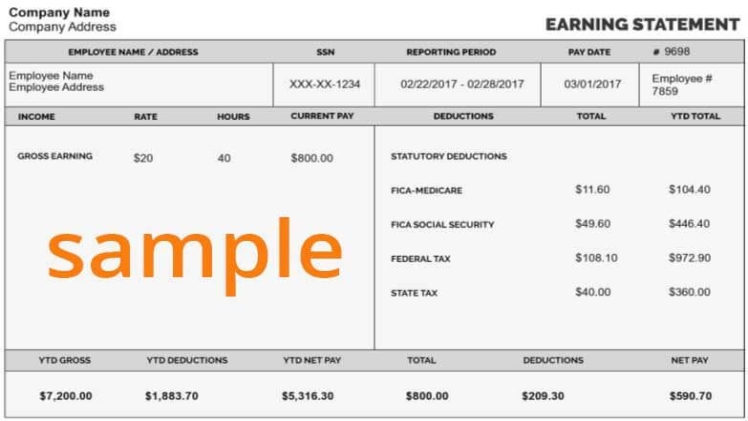

If you are willing to make the stub yourself then there is much software available on the Internet to help you out. For example, on the Internet, you will be finding free software and applications to help you out in this regard. Over there you will be needing to fill-up the form related to the salary of the employee. It will be mentioning the company of the employee and at the same time Salary, he is getting paid.

Follow the law of the country

if you are living in America and you are officially making the stub then you should know the law of the country . Are you allowed to do it yourself or should you hire the service of the professional. Professionals will be able to help you out in this regard very easily but if you are not willing to pay them the money then you can do it yourself only if the government is allowing you. As I have told you before that the software and applications available on the Internet are going to give you the benefit in this regard. They will be able to help you out to make the pay stub for free when in fact if you will hire the service of the professional then you will be needing to pay those hundreds and thousands of dollars.

The government requires filing

The reason a pay stub is required from the employer or the employee because the government needs the paperwork to know that how much tax has been paid. If you are the employer then it is your responsibility to make the pay stub for the employee and if you are the employee and the employer is not giving you the pay stub then you can file the violation before the government agency abducts you.

They will be able to help you out to make the pay stub for free when in fact if you will hire the service of the professional then you will be needing to pay those hundreds and thousands of dollars. You can also use a special pay stub generator to make the process more simple.

Go for a paid software

If you can afford then you can prefer to choose the paid software available on the Internet which can allow you to make the pay stub easily. Because the paid software will be having full-fledged facilities for the consumer to choose from. If you are willing to make the pay stub with all the facilities, then the paid software will be able to provide you that without any hesitation. Even though free applications are available on the internet , paid software is preferred. But if you are not willing to pay the money in this regard then the free software is available very easily and even the applications for the mobile phone are available on the internet for you to download and make the pay stub on.

Self-Independent are prone to it

Many people who are self-learning are preparing to make the pay stub of themselves. Many people are freelancers and that is why they are not bound under one company to earn the money. This is where the online paystub system is going to help you out and you will be able to make the pay stub according to the money you are getting and at the same time the tax you are paying to the government yourself. It is easy and good for the 1099 independent contractors free of any company to make the pay stub, so when they are filing the annual tax returns then they can show the government the tax and the revenue they are giving to the government to get the refunds if there is any.