Tax preparation can be complicated and stressful. Most Canadian taxpayers have simple returns that can be self-prepared with help of a tax software program. A simple return requires one or two slips of financial data. Think of preparing your tax return as a data entry exercise that may pay you a federal refund. Take a look at how easy it can be to prepare your taxes in Canada.

DIY personal income taxes are easier than you think.

Paying a professional tax preparer needlessly can be expensive. All it takes to DIY your tax return is the right tax software and a clear mind. Within a couple of hours, you can have a completed tax return ready to e-file to the Canada Revenue Agency. Tax software streamlines the preparation process by prompting you to answer questions and input information from specific tax forms.

Online tax preparers and download products take the guesswork out of the tax preparation process. Preparing your taxes with a software program is the best way to maximize your refund and tax deductions, and ensure accurate calculations. When deciding on the right tax prep software for your needs, it helps to read product reviews. Wealth Rocket offers a thorough overview of the pros and cons of tax software products SimpleTax and Turbo Tax Canada.

SimpleTax is a free online tax preparer that features a maximum refund guarantee. It’s NETFILE-approved, meaning you can file directly to the Canada Revenue Agency for the fastest refund. It features previous return storage, auto-fill of financial information, and a $0 fee refile option. SimpleTax also features a smart search that finds all applicable tax deductions and credits and optimizes your refund to best benefit your tax situation.

TurboTax is an Intuit product full of features that help tax filers quickly and easily file their returns. TurboTax products offer tiered pricing depending on your tax situation. It’s also NETFILE-approved and features an instant refund tracker as you enter your financial data. You can link your CRA account to import tax documents and auto-fill your tax return. TurboTax can help you determine the right deductions and credits to claim, and it features review and assist with a real tax expert. The product is known for great customer service, and best of all, you can manage your filing with a mobile app. There are several paid versions of TurboTax depending on your tax situation. Preparers can rely on the TurboTax free edition, the TurboTax self-employed edition, TurboTax Business, and the TurboTax Live Full Service for complex and simple returns alike.

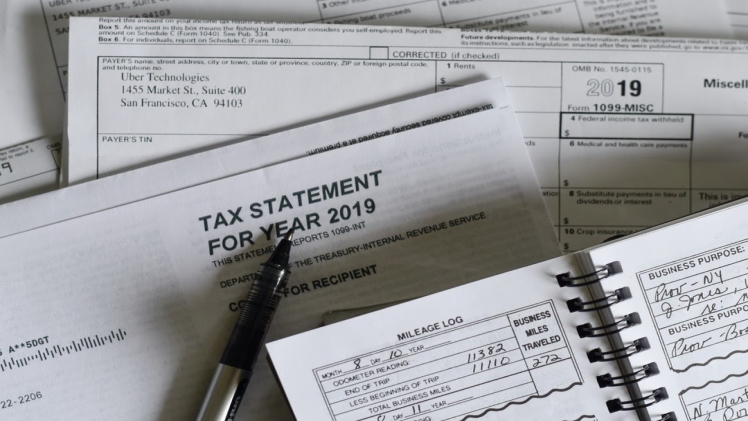

Gather up your documents before you begin to prepare your taxes.

You’ll save yourself a lot of time and headache by collecting all the necessary financial data you’ll need to prepare your tax return. You’ll need to gather your previous tax year’s notice of assessment, a copy of last year’s return as a model, and reliable tax software. Setting up an online account with the Canada Revenue Agency will make it easier to access your tax information and file your return. Other important documents include tax slips for various types of income, receipts of RRSP contributions and eligible deductions and credits, and receipts for any claimable work-related expenses.

Know when to hire a professional tax preparer.

When dealing with a complicated tax situation, it’s a good idea to work with a tax expert whose area of expertise includes complex tax scenarios. Declaring bankruptcy, filing for an estate, and cross-border tax situations are scenarios that merit expert review and preparation. You should also consider working with a professional tax preparer when selling real estate, when facing capital gains taxes, or when you purchase property abroad.

It’s not difficult to prepare your taxes when it’s filing time in Canada. All you need is a clear mind, the right financial information, and the right tax preparation software.